Following earlier publications, Radiocommunications Agency Netherlands asked if we could perform an analysis of the Dutch market – in particular, the routing arrangements between networks.

Repeating some of the analysis we did for previous country reports on the set of Dutch Autonomous System Numbers (ASNs), we quickly noticed some important differences. Because the Netherlands is a relatively small country, but also part of the European Single Market, geographical borders become even less visible than they usually are.

The Dutch access market in particular is not only highly consolidated, but also served by a number of pan-European networks. Some of these ASNs registered in the Netherlands are also used to provide services to other markets – but we have also found several non-Dutch ASNs playing an important role in the Dutch market.

What is more, a recent wave of mergers and acquisitions means that, from a network perspective, the Dutch market is subject to some substantial changes. The merger of UPC/Liberty Global and Ziggo, followed by the merger between Ziggo and Vodafone, is clearly visible from some of our datasets, where it appears a substantial number of customers have now been moved to a new ASN. Similarly, the recently-announced merger between Tele2 and T-Mobile Netherlands appears to have also left its mark, as seen in recent routing changes.

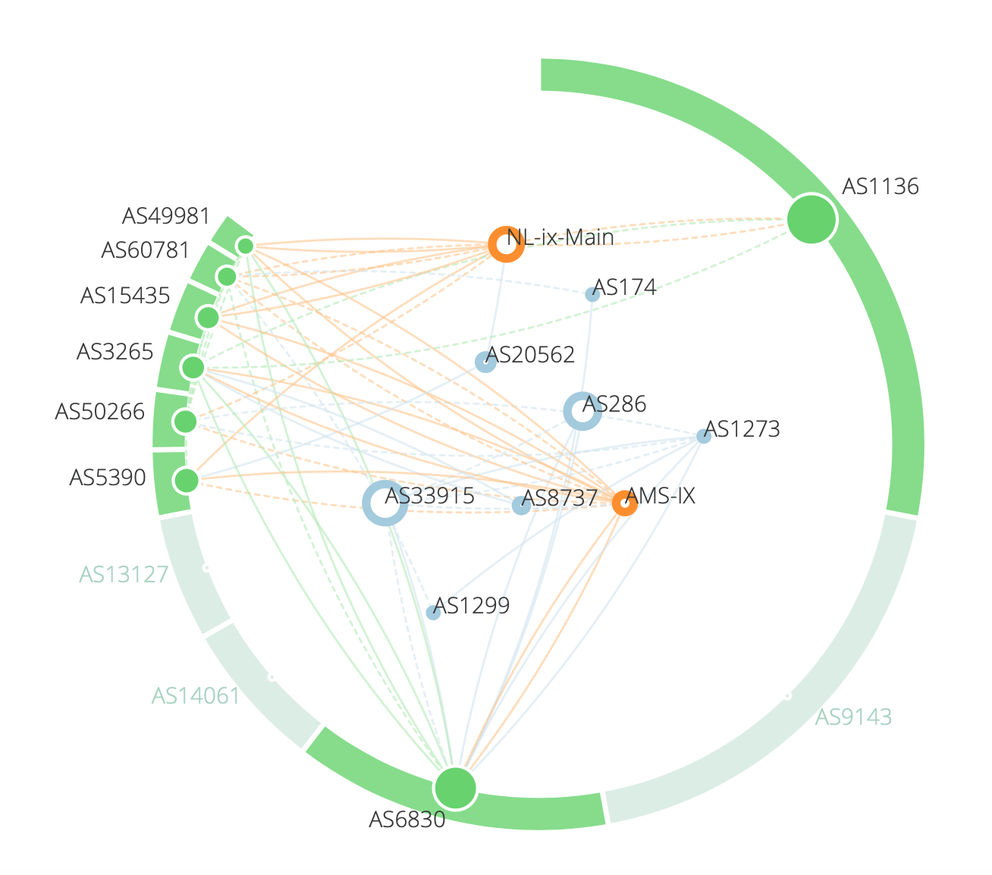

Connectivity Between Dutch Users

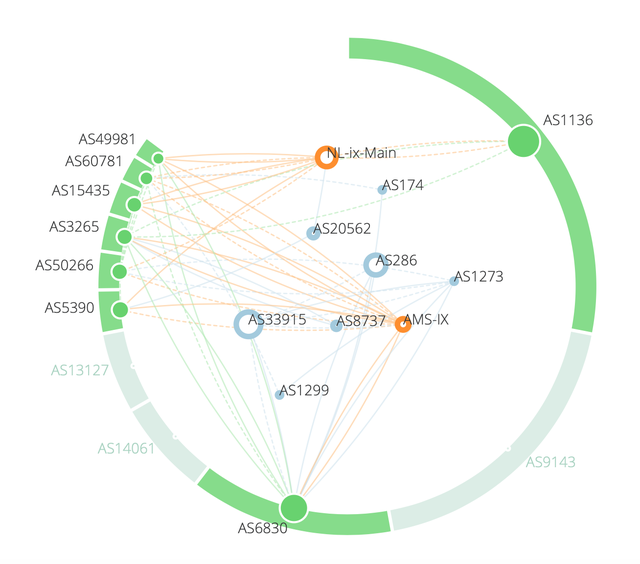

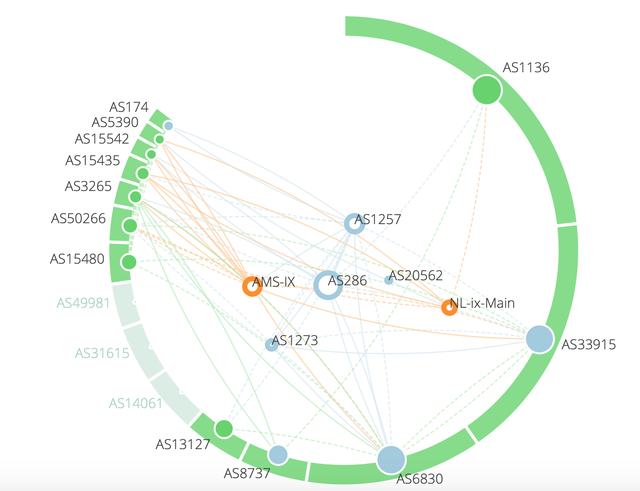

As our RIPE Atlas probes get moved together with the connections, this becomes visible in our tooling such as the IXP Country Jedi, which no longer has a view from certain larger ASNs such as Ziggo (AS9143) and Tele2 (AS13127):

A more recent dataset now shows that some of these users have moved to another ASN (AS33915), marked as Vodafone, which recently acquired the Dutch operations of Ziggo.

We expect this to shift a bit more as the mergers are finalised.

International Connectivity to Dutch Networks

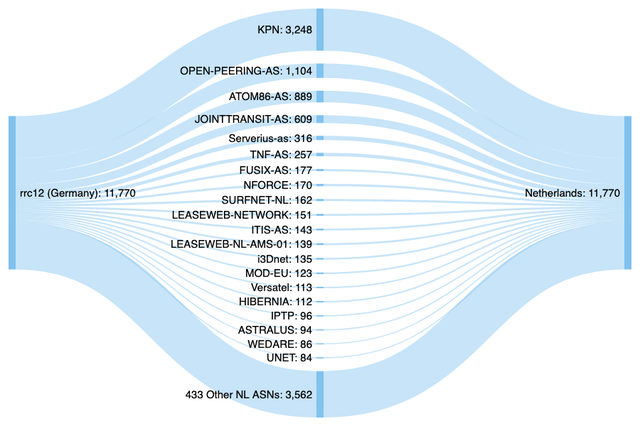

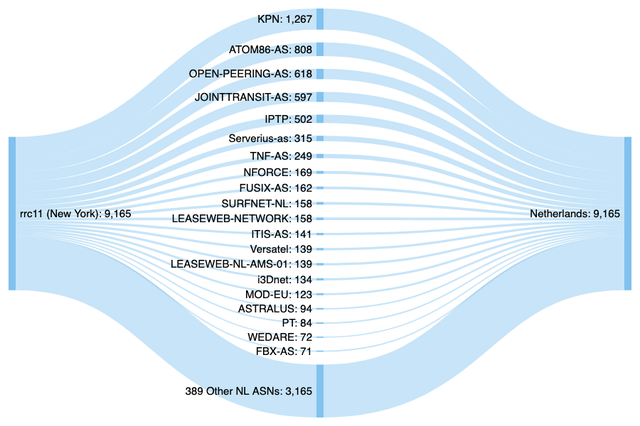

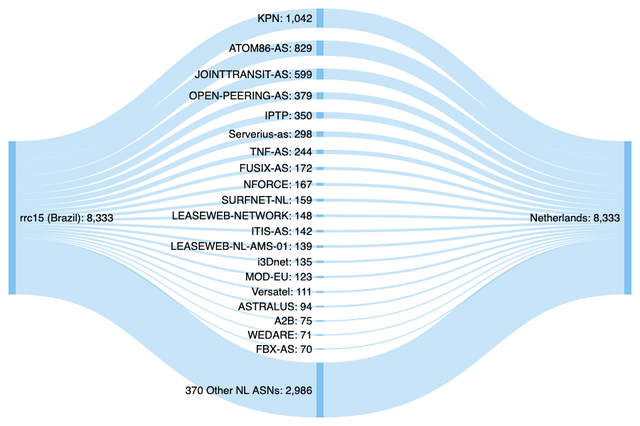

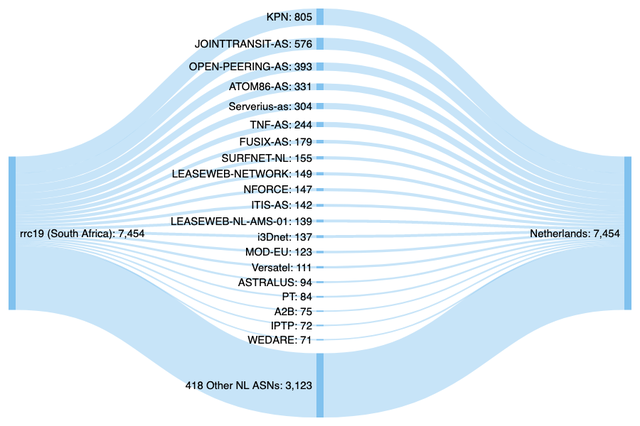

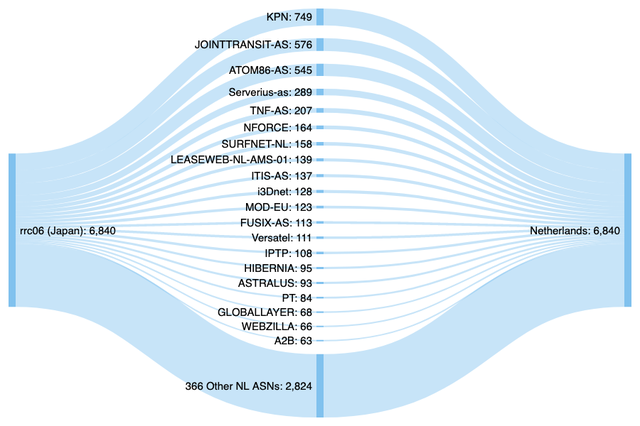

Apart from using our existing tooling, the report is also based on some bespoke analysis. Based on data gathered from our RIS route collectors, we tried to establish how Dutch networks are seen from different points in the world. The result of this analysis should paint a rough picture of which networks play an important role in providing international connectivity.

We started by selecting all prefixes covered by IP ranges registered to organisations based in the Netherlands. For this mapping, we used RIPE NCC's public statistics on the allocated and assigned blocks. Next, we extracted all the AS paths for these prefixes and the first ASN in the path that is registered to a Netherlands-based operator (again using the public delegation statistics).

Aggregating the number of unique combinations of prefix and ASN, the resulting view gives some indication of the networks that play a role in providing (international) connectivity to Dutch prefixes. We performed the analysis on data from our route collectors in Germany, the United States (New York), Brazil, Japan and South Africa.

Looking at the Netherlands from our collector in Frankfurt, we see a significantly higher number of unique combinations of ASN and prefix (11,770) than any of the other vantage points. We suspect this is due to the relative proximity of the DE-CIX exchange point as well as the European Single Market, making it relatively easy and affordable for Dutch networks to connect to IXPs in neighbouring countries. The relatively high number of Dutch networks present in Frankfurt means that there is more diversity in the paths back to the Netherlands. The relatively high diversity is also exemplified by the higher number of "other", indicating that there is a rather large tail to this dataset.

Looking further away, from the Americas, we see that diversity decrease a little, with fewer unique paths visible in our data.

There appears to be significant overlap between the views from Sao Paolo and New York, which is not very surprising as we would expect the majority of the traffic between the Netherlands and Brazil to travel along the US East Coast and share similar paths.

The Dutch incumbent KPN remains in the top rank, which could be caused simply by its relative market share in the retail access market.

Looking at the situation from Japan and South Africa, as expected the number of diverse paths further decreases with distance.

While many of the larger networks remain in the top ranks, we see some noticeable shifts – especially from Japan.

The other thing that became evident when preparing these datasets is that we found approximately 3,000 IP prefixes that have their country attribute set to the Netherlands, but which are not announced from an ASN that is also registered within the Netherlands. We can only guess at the reasons for this, but we expect that this is also partially caused by the European market conditions, which allow for easy consolidation across borders.

The same situation might arise when a Dutch network uses an upstream network with an ASN that is not registered in the Netherlands. In this analysis we only looked at the first Dutch ASN as it appeared in the BGP path. In such cases the traffic may already have entered the country before it arrives at the Dutch ASN we recorded.

However, from a high-level perspective, we are confident that the pictures above sketch a reasonably accurate picture of both the diversity of network providers as well as the concentration towards a small number of networks that appear to play a significant role in connectivity to and from the Netherlands.

Comments 3

The comments section is closed for articles published more than a year ago. If you'd like to inform us of any issues, please contact us.

Jair Santanna •

Very interesting post. Where can I find more information about your " IXP Country Jedi". Is the visualisation based on from/to all Atlas probes in a country (i.e., all possible pairs), for example NL? How did you infer the IX? How did you infer transit and end-users? I would be glad to further contribute with it, I just need to understand a bit more.

Marco Hogewoning •

Hi Jair, There is actually a lot more information about IXP Country Jedi on this website, for instance here https://labs.ripe.net/playground/ixp-country-jedi/ixp-country-jedi, which will also guide you to the interfaces you can use to retrieve information about a particular country. Please keep in mind that this tool is still being refined and further developed, things might not always be complete or change over time. There is also a dependency on having RIPE Atlas probes in a particular country and its networks to do the measurements required, so the actual results vary per country based on probe availability.

ciqu •

I wonder which tool you use to plot the pictures Connectivity Between Dutch Users. Thanks very much