We’ve heard from the RIPE NCC’s Managing Director Hans Petter Holen on the overall picture of the Draft Activity Plan, now we hear from the RIPE NCC’s Chief Financial Officer, Simon-Jan Haytink, who takes us through the draft budget for 2025.

Draft Activity Plan and Budget 2025

The Draft Activity Plan and Budget 2025 outlines the RIPE NCC’s plans for the coming year, along with the associated costs to achieve them. This document is essential in maintaining the trust of our membership by upholding high standards of transparency and accountability. It offers a clear view of how we will allocate resources and sets the direction for the RIPE NCC's activities in 2025. Your feedback is crucial, as it can influence the course we take in the coming year and beyond.

The draft has now been published, and the RIPE NCC is actively seeking input from the membership and wider RIPE community. The consultation is open and we will also engage in further discussions during the RIPE NCC General Meeting. The document will then be reviewed and then finalised and approved by the RIPE NCC Executive Board before being published in December.

RIPE NCC Charging Scheme: A Path Forward

In 2023 and 2024, the RIPE NCC Management and Executive Board undertook significant work to refine the organisation's charging schemes to ensure continued support for our members and to meet the evolving needs of the community. After the membership rejected a category-based model in 2023 and made similar objections to alternatives in 2024, it became clear that a new approach was needed.

To address this, in June 2024, the Executive Board formed a task force to define principles for a future charging scheme. While the task force works to improve the Charging Scheme process, we at the RIPE NCC remain focused on cost control, a path we started on in 2020 when we implemented a new financial governance model. While continuing to prioritise cost efficiencies next year, we are also making a conscious decision to allocate additional budget to strengthen our resilience, particularly in the area of Information Security, to protect both our members and the stability of the RIPE NCC as an organisation.

There has also been a change in our company culture, where there is now a much greater cost consciousness internally, resulting in considerable reductions across the board. As CFO, I am well aware that this will need continued attention, and we are in no way done with these efforts.

2025 Income

In May, members voted on the Charging Scheme for 2025 resulting in an LIR fee of EUR 1,800, a 250 EUR increase from this year. This adjustment, along with an increase in the fee for independent resources from 50 EUR to 75 EUR, and the introduction of a 50 EUR ASN fee, has allowed us to budget for an 8% increase in income compared to our 2024 budget.

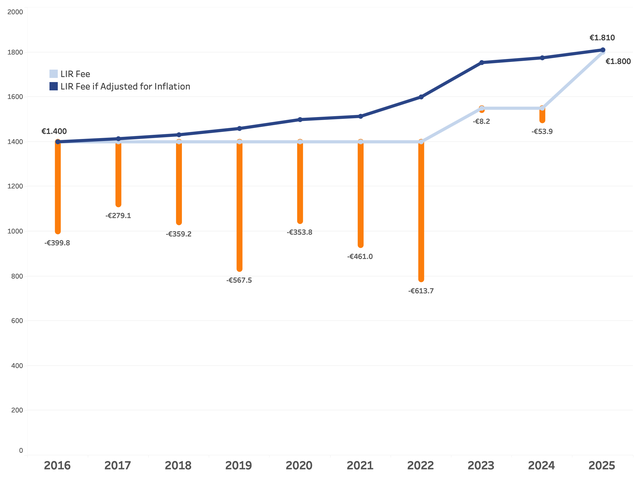

Notably, this change in the LIR fee brings it back to the level it was in 2013, when there were just under 10,000 LIRs. Since then, the fee gradually decreased to €1,400 in 2016, but if inflation had been applied since then, the LIR fee would now stand at approximately €1,810. Essentially, the fee has been brought back in line with where it would be if we had been making inflation adjustments.

As you can see in the graph below, the LIR fee has remained stable in recent years alongside the sustained influx of new LIRs, peaking at 25,125 LIR accounts in 2019. This enabled us to redistribute 60 million between 2015 and 2023, effectively lowering the annual invoice amount over this period.

However, in recent years the steady increase in LIR accounts that previously supported lower membership fees and a higher redistribution has ended. This, together with the consolidation of multiple LIRs, means that these high redistribution levels are probably a thing of the past.

For 2025, we estimate a stable number of around 20,000 LIR accounts, which aligns with the number of members. This estimate is conservative, yet realistic given ongoing consolidation trends. Importantly, for this reason we are now basing our income on the number of members rather than LIR accounts.

Our 2025 budget income also includes contributions from Ultra High Risk Countries (UHRC). UHRC is a term used by three major Dutch banks and includes countries such as Iran and Syria. As it stands, these banks will not accept funds from these countries, though we have been working with our banks in the Netherlands and members in affected countries, and we are hopeful that we can provide a solution in the near future, though an exact timeline remains uncertain due to the high level of complexity involved here. We will have 4.7 million outstanding from UHRC, including an estimation for 2025 of EUR 1.1 million in outstanding income. If we succeed in collecting income from these regions, the funds will be integrated into our operational result and will be subject to a redistribution vote when the time comes.

Cost Budget 2025: Strategic Initiatives

Due to our focus on cost efficiency over the past few years, we can present a cost budget in line with 2023 while continuing to provide all of the services our members rely on. Our total operating expenses (OPEX) are set to increase by 5%, or EUR 1.8 million, compared to the 2024 budget and our full-time equivalent (FTE) count will also grow by 3%, or 5 FTEs.

This increase reflects our commitment to these strategic initiatives:

- Information Security: A key focus for 2025 is strengthening our Information Security capabilities. The Board has approved the addition of a new FTE for this area, along with 900 kEUR in operational expenses. This includes 400 kEUR for software expenses. It is difficult to recruit qualified staff in this area, so we have allocated 500 kEUR which could be used for consultancy to support these projects or to recruit FTEs if the right talent can be found.

- Registry Monitoring and Technology: We will be adding capacity to our registry monitoring efforts, to increase Assisted Registry Checks (ARCs). Furthermore, three new FTEs in Technology will transition work from consultancy to long-term internal roles, aligning with our strategy to rely on permanent staff for ongoing needs while using consultants for specialised, short-term projects.

- Finance and ERP Optimisation: Our Finance team will recruit a new specialist system administrator. This new addition will help optimise the use of our ERP system in relation to our administrative processes. This specialist will also help to implement Information Security and Compliance requirements

Overall, the budget also includes general salary increases for staff, and we accounted for inflation. Looking more in depth at the different activity areas, the External Engagement and Community budget has had no major changes. The 2% increase here reflects a standard correction for personnel costs and inflation.

Information services also sees a modest cost budget increase of 2% or 200 kEUR, the achieved cost savings have been repurposed in the budget to improve services. Since Felipe became CTO, we have taken a deep dive into the numbers for Information Services. We reallocated some budget to better reflect reality, which resulted in the RIPE Atlas budget going up by 200 kEUR, though technically this is not more overall spending but an internal budget allocation correction. The RPKI budget is down now that a solid foundation has been established for RPKI over previous years. The focus can now shift to maintaining stable operations and development at a reduced budget.

The Registry budget has increased by 600 kEUR (12%), reflecting our focus on enhancing the accuracy, compliance and resilience of registry data. We will be providing our Registry Monitoring team with more resources so they can perform more Assisted Registry Checks (ARCs) and in-depth investigations into Registry data accuracy. The team will play a critical role in bolstering our sanctions screening processes to ensure we remain compliant and build on the resiliency of our Registry.

And last but not the least, the largest increase, Organisational Sustainability has seen a 875 kEUR increase, which is mainly explained by the budget increase for Information Security and Compliance already mentioned above, which underpins the main focus point for the RIPE NCC in 2025. We will also add one FTE to our Finance team to support our efforts in optimising our enterprise resource planning (ERP) system. Our legal consultancy expenses are expected to increase by 150 kEUR due to the new EU and Dutch legislation we are obliged to implement in 2025. You can read more about our focus points and why we have concentrated on Information Security in Hans Petter’s Labs article.

The specific areas for budget increases consist of:

- EUR 1.5 million or 6% in Personnel Costs

- EUR 0.3 million or 9% Consultancy

- EUR 0.2 million or 6% in Information Technology

- EUR 0.1 million or 9% in Housing and insurances

Balancing New Investments with Cost Savings

We are balancing these investments in critical areas with careful financial stewardship. As mentioned above, there is an increased focus on cost consciousness internally which is resulting in a high number of cost reductions across the board. As CFO, this will continue to be a key focus in the years to come.

This year, these efforts have included reducing our data centre footprint—a move that is partially offset by increased cloud usage for measurement services. As we go from 46 to 22 racks, our data centre costs will decrease by roughly half – from 850 to 360 kEUR per year. This reduction will continue throughout 2025, as we reach a total footprint of 10 racks by the end of next year.

Top areas for budget reductions are:

- EUR 0.3 million or 21% in Contributions

- EUR 0.1 million or 13% in Depreciation

Additionally, we have identified opportunities for budget reductions in areas like depreciation as we have seen lower than budgeted capital expenditure in previous years, and reducing our contributions to external organisations. We have also paused the Community Projects Fund, which will be reviewed in 2025.

Financial Result and Redistribution

Our budgeted operational result for 2025 is EUR 1.1 million. This amount will be subject to the annual redistribution vote by members at the General Meeting, and while the outcome depends on a full year of operating, our commitment remains to operate within the established budget. Furthermore, our financial result is budgeted at 800 kEUR for 2025, which aims to offset the impact of inflation on our reserves.

Financial reserves are crucial for Regional Internet Registries, since they ensure operational stability. This stability is crucial given our role in maintaining services that support global Internet infrastructure. Reserves allow us to continue providing services during unexpected events or economic downturns. They also act as a buffer for risk management, help maintain fee stability for members, and enable long-term planning and investments without relying on current income. Overall, reserves mean that we can adapt to challenges while maintaining stable and reliable services for the Internet community.

| B2026 | B2025 | 2024 Forecast | B2024 | |

|---|---|---|---|---|

Income |

41.1M EUR |

41.1M EUR |

35.6M EUR |

38.0M EUR |

Expenditures |

41.0M EUR |

40.0M EUR |

37.4M EUR |

38.2M EUR |

Redistribution |

0.1M EUR |

1.1M EUR |

(-1.8)M EUR |

(-0.2)M EUR |

Financial Result |

1.1M EUR |

0.8M EUR |

0.6M EUR |

0.4M EUR |

Surplus |

1.1M EUR |

1.9M EUR |

(-1.2)M EUR |

0.2M EUR |

Number of LIRs |

20,000 |

20,000 |

20,500 |

21,500 |

Average Cost per LIR |

2,048 EUR |

2,000 EUR |

1,825 EUR |

1,777 EUR |

Looking Ahead to 2026 and Beyond

With the current charging scheme, we are confident in our ability to maintain a similar budget for 2026, including adjustments for inflation and general salary increases. As we plan for the future, our focus remains that our financial reserves are well-positioned to support the stability of our operations and with that, the needs of our members.

The 2026 budget prediction is based on maintaining the Charging Scheme from 2025, with no changes. The current Charging Scheme is based on the number of active members, which stands at 20,000, rather than the number of LIRs. As a result, our budget is more conservative and stable compared to previous years as we do not have any reason to believe that the number of members will decline significantly.

On the cost side, we have factored in no changes to the budget other than a modest 1.5% inflation correction and a 3% general salary increase. This careful budget planning gives us the confidence that we will be able to present a break-even budget or better in 2026, even while accounting for the new strategic initiatives planned for 2025. While these new initiatives will not be automatically added to the 2026 cost budget, this financial flexibility supports them if required. The financial result is also expected to increase over time, as we plan to increase the value of our reserves in line with our treasury statute. This strategic approach, combined with prudent financial management, ensures that the RIPE NCC remains resilient and responsive to the evolving landscape, always with our members’ interests at the forefront.

Comments 0

The comments section is closed for articles published more than a year ago. If you'd like to inform us of any issues, please contact us.