In May 2015, we looked at IPv4 transfers in the RIPE NCC service region and found signs of an emerging market. Both the number and size of transfers conducted under RIPE Policy showed an upward trend in the years 2013-2014. One year later, we take another look. Did this trend continue? What have been the effects of the inter-RIR transfer policy?

Allocated PA and Assigned PI Space

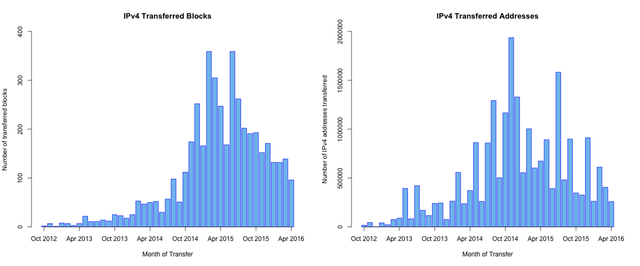

Between 1 May 2015 and 1 May 2016, 7,374,080 addresses (about 44% of a /8) were transferred under the RIPE IPv4 transfer policies for allocated PA and assigned PI space. This is lower than the preceding 12 month period (May 2014 to May 2015) when 11,048,192 addresses (about 66% of a /8) were transferred. While the total number of transfers in the last 12 months has increased from 1,903 to 2,197, as Figure 1 demonstrates below, the general trend in this period is downward. The number of transfers conducted in April 2016 is less than a third of what was observed for June 2015.

Figure 1: Number of IPv4 transfers and number of IPv4 addresses transferred in the RIPE NCC service region

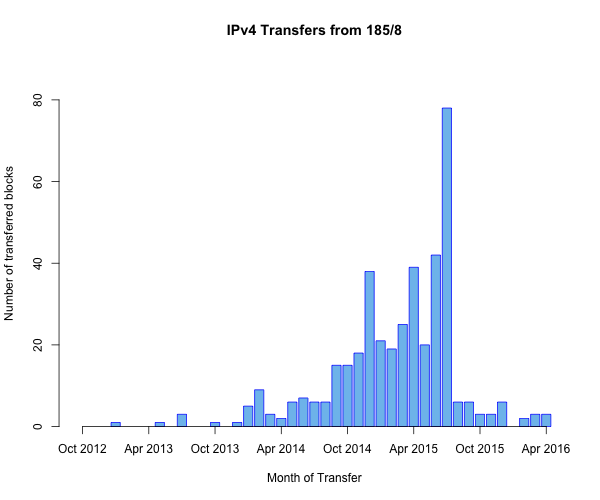

As noted in our previous article , the number of transfers from 185/8 (the "last /8") started to increase in the fall of 2014. The majority of these transfers happened within a few months of the allocation being made. Because this was felt to be in conflict with the spirit of the allocation policy , members of the RIPE community made a proposal to prevent transfers for the first 24 months after receiving an allocation from the RIPE NCC. After much discussion, the policy proposal was accepted and implemented on 23 July 2015. The effects of the policy change are very visible in Figure 2, which shows the number of monthly transfers from 185/8. After a record number of 78 transfers in July 2015, the transfer rate of last /8 allocations came down hard in subsequent months. From 1 August 2015 to 1 May 2016, only 32 transfers were registered in this space, with an average age of the allocation (at time of transfer) of 25 months.

Figure 2: Transfers from the last /8

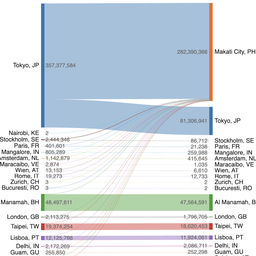

Transfers per Country

To see how transfer activity is spread across the RIPE NCC service region, we aggregate the transfer data by country. For each transfer, we determine the originating and receiving country by locating the transferred block in the RIPE NCC delegation statistics archive before and after the date of transfer. For each country, transfers fall into one of three categories:

- Import: the transferred block originates in a different country

- Export: the transferred block is destined for another country

- Domestic: the transferred block stays within the country

The sum of all three is what we call "market size", a measure for the amount of addresses which changed holder in each country over the last 12 months.

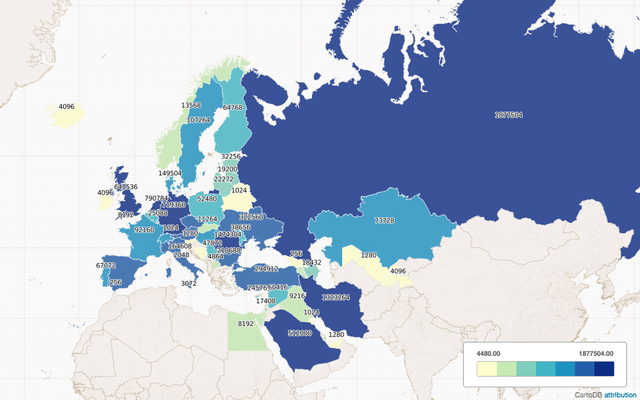

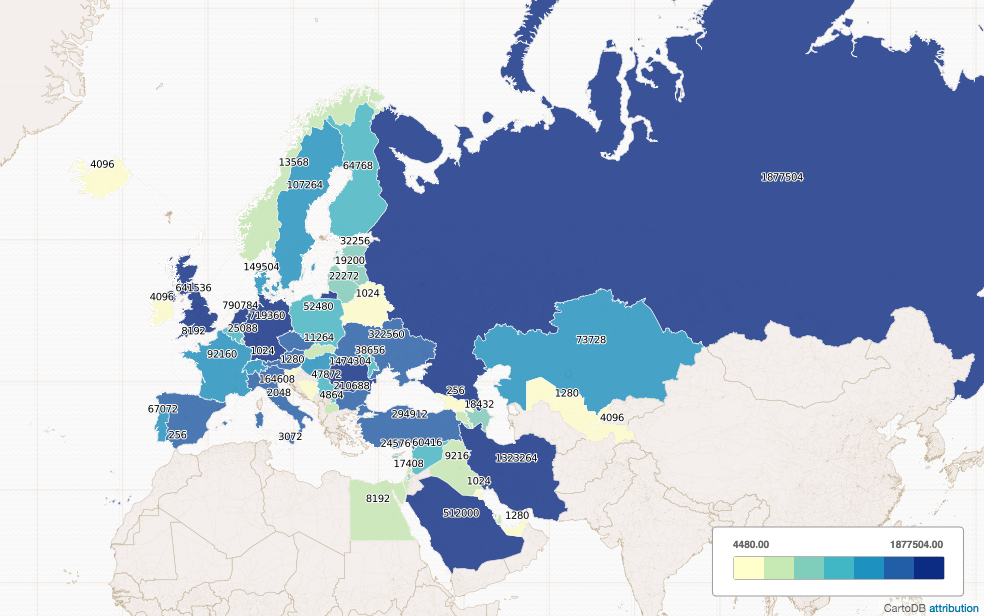

Figure 3: Geographic distribution of the last twelve months of IPv4 transfers

Figure 3, a screenshot of an interactive map , visualizes the results. The map colour-codes the countries by market size. The darker the colour, the more addresses were transferred to, from or within the country. Russia, Iran, Saudi Arabia, Romania, Germany, the Netherlands and the United Kingdom stand out as places with the most transfer activity between 1 May 2015 and 1 May 2016.

Looking at the details per country, shown in Table 1 below, we see different patterns in transfer activity. Russia saw about 1.9 million IPv4 addresses change holder; about two thirds (66%) of these were domestic transfers from one Russian organisation to another. In Iran, domestic transfers only account for 38% of the transferred addresses and Saudi Arabia relies almost exclusively on imports.

Just as last year, Romania is the top exporter, with 1 million transferred IPv4 addresses. However, not all of these addresses had been allocated to Romanian LIRs before. A closer look at the

transfer statistics

shows 393,216 of the transferred addresses were from 51/8; a block which until May 2015 was

legacy space

held by the

UK's Department for Work And Pensions. What seems to have happened is that addresses were first transferred as legacy from the UK to Romania, after which the receiving LIR chose to have the legacy status of the transferred blocks removed before the addresses were transferred again, now with the status Allocated PA. Because the policies for transfers in the RIPE NCC service region do not apply to legacy resources, only the second transfer is listed in the transfer statistics, thus leaving an imbalance in Romania's aggregated statistics.

| Country | Imports | Imported IPv4 | Exports | Exported IPv4 | Domestic Transfers | Domestic IPv4 | Market Size |

| RU | 11 | 6400 | 108 | 635136 | 268 | 1235968 | 1877504 |

| RO | 9 | 3072 | 386 | 1033728 | 627 | 437504 | 1474304 |

| IR | 113 | 823296 | 3 | 2304 | 32 | 497664 | 1323264 |

| NL | 62 | 421888 | 29 | 124672 | 44 | 244224 | 790784 |

| DE | 53 | 80896 | 54 | 421120 | 63 | 217344 | 719360 |

| GB | 80 | 115968 | 27 | 340992 | 51 | 184576 | 641536 |

| SA | 9 | 509952 | 0 | 0 | 1 | 2048 | 512000 |

| ES | 73 | 455168 | 10 | 10240 | 25 | 38656 | 504064 |

| UA | 7 | 20224 | 14 | 72960 | 56 | 229376 | 322560 |

| TR | 14 | 11008 | 2 | 16384 | 8 | 267520 | 294912 |

Table 1: Top ten countries by IPv4 transfer market size

Top Recipients and Originators

Aggregating the transfer data of the last 12 months by receiving or originating party shows which organisations have high demand for IPv4 and which are more happy to part with it. Table 2 lists the top ten recipients, ordered by total number of addresses transferred between 1 May 2015 and 1 May 2016. Four organisations, Mobile Communication Company of Iran, Saudi Telecom Company, Vodafone Espana and Superonline Iletsim Hitmetleri, were also present in last year's top ten.

Liberty Global Operations B.V. is new in this top ten, with 327,680 addresses coming to the LIR via transfers. However, the transfer statistics reveal that the address blocks involved were transferred from UPC Austria GmbH and Virgin Media Limited respectively. Both entities are, like Liberty Global Operations B.V., subsidiaries of Liberty Global Plc. This illustrates how not all transfers in the allocated PA transfer statistics are necessarily the result of brokered transactions on the IPv4 market. Organisations holding multiple LIRs can also use the transfer policy to move IP addresses within the organisation or change how the addresses are administered.

| Organisation | Transferred IPv4 Addresses |

| Mobile Communication Company of Iran PLC | 622592 |

| Saudi Telecom Company JSC | 393216 |

| JSC "ER-Telecom Holding" | 362752 |

| Liberty Global Operations B.V. | 327680 |

| VODAFONE ESPANA S.A.U. | 318464 |

| "University Telecommunications" Ltd. | 270848 |

| "Rightel Communication Service Company PJS" | 217088 |

| Superonline Iletisim Hizmetleri A.S. | 196608 |

| Vodafone Libertel B.V. | 172032 |

| O2 Czech Republic, a.s. | 163840 |

Table 2: Top ten recipients, ordered by size of transferred space

Table 3 lists the top ten organisations that originate transfers. As last year, Jump Management remains the top supplier, but they continue to cater to organisations with modest demands - 60% of their 144 transactions (transfers of one or more blocks to the same organisation on the same day) involve at most 2,048 IP addresses: a /21 or smaller.

| Organisation | Transferred IPv4 Addresses |

| Jump Management SRL | 555776 |

| S.C. GVM SISTEM 2003 S.R.L. | 458752 |

| GOSTARESH-E-ERTEBATAT-E MABNA COMPANY (Private Joint Stock) | 376832 |

| Perspectiva Ltd. | 360448 |

| Link Telecom LLC | 276480 |

| State Institute of Information Technologies and Telecommunications | 270848 |

| ISP-Service AG | 262144 |

| IPv4 Management SRL | 239872 |

| Turkcell Iletisim Hizmetleri A.S | 196608 |

| Virgin Media Limited | 196608 |

Table 3: Top ten originators, ordered by size of transferred space

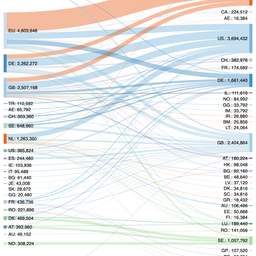

Inter-RIR Transfers

On 30 September 2015, following successful implementation of " Policy for Inter-RIR Transfer of Internet Resources ", it became possible to transfer resources to other RIR service regions. Since then, we have recorded two transfers from the RIPE NCC to another RIR (a /22 and a /23, both transferred to ARIN) and 47 transfers from another RIR to the RIPE NCC. A closer look shows that several transfers took place on the same date with the same origin RIR and the same recipient organisation on the RIPE NCC side. Grouping these together, we find only 20 transactions in the inter-RIR transfer arena. In total, 2,497,280 IPv4 addresses have been transferred to the RIPE NCC service region. The largest part of these, 2,097,152 addresses (the equivalent of a /11) came to the RIPE NCC service region in a single transaction. On 28 December 2015, eight legacy /14s were transferred from ARIN to Softlayer's RIPE NCC LIR account. The next five largest recipients in terms of address space each had about a /16 of IPv4 space transferred to the RIPE NCC service region. Table 3 lists the top ten.

| Organisation | Transferred IPv4 addresses |

| SoftLayer Technologies, Inc. | 2097152 |

| RGnet, LLC | 67072 |

| SALAR LLC FZE | 65536 |

| A&F Networks B.V. | 65536 |

| Public Telecommunication Corporation | 65536 |

| SIEMENS AG | 65536 |

| INTER NET BILGISAYAR TURIZM TIC LTD STI | 17664 |

| TELE AG | 16384 |

| Awaser Oman LLC | 8192 |

| Sewan Communications S.A.S. | 8192 |

Table 4: top ten organisations receiving address space via inter-RIR transfers to the RIPE NCC

Conclusion

In the second half of 2015 and the first half of 2016, both the number of transfers and the size of the transfers conducted under RIPE Policy started to show a downward trend. This is more likely a sign of fewer available addresses rather than decreasing demand for IPv4 addresses. Also, we have to stress that statistics for IPv4 transfers within the RIPE NCC service region only concern address space with the status Allocated PA or Assigned PI. Because legacy space is not subject to the RIPE transfer policies, the RIPE NCC cannot track or publish transfers in this area. Inter-RIR transfers are still too small in number to see any trend. In terms of the number of transferred IPv4 addresses, statistics are dominated by a single transaction, eight /14s transferred from ARIN to the RIPE NCC in December 2015.

Comments 1

The comments section is closed for articles published more than a year ago. If you'd like to inform us of any issues, please contact us.

Riccardo Gori •

Great analisys work! thank you