Internet exchange points (IXPs) are among the most popular ways for Internet service providers (ISPs) and content distribution networks (CDNs) to exchange traffic. This article gives an analysis of the distribution of vendors chosen by IXP members to connect to IXPs.

In this post, we analyse the hardware that they use to connect to IXPs. We investigate 24 IXPs distributed across fifteen countries, from the EU, US, Africa and Brazil, which together interconnect more than six thousand IXP members. Our goal is to determine if there is market dominance by the some of the hardware vendors among IXP members.

Connecting to an IXP

An IXP provides a location at which ISPs, CDNs and others can exchange traffic. The main incentives are to reduce cost and improve latency, given that members can connect to each other directly instead of having to rely on large (and paid) upstream providers.

Given that all protocols required for peering are open, IXP members can choose from a range of hardware vendors to connect to an IXP. Currently, vendors from the US (like Cisco, Juniper) and China (Huawei) are among the most well-known network equipment manufacturers that vendors can use.

In this blog, we dig into the popularity of vendors/brands among IXP members across major IXPs worldwide. We are aware that choices of brands are influenced by economics, operational preferences and hardware capabilities.

IXP Infrastructure

The infrastructure of an IXP supports traffic exchange between multiple autonomous systems (ASes), as illustrated in Figure 1. It consists of router servers, looking glasses and routing policy coordination.

The IXP members, in turn, connect to the IXP's infrastructure by placing their network equipment (usually a router) in the IXP’s network. This equipment is responsible for defining the routing policies and performing the traffic exchange among the members. The concentration of ASes at a single location makes the traffic exchange more convenient and cheaper for IXP members.

Figure 1: Internet Exchange Point (IXP) infrastructure

Measuring IXP Members’ Hardware Vendor

How can we determine what vendors IXP members are using? The simplest and most direct way is through the MAC addresses of the equipment that members use to connect to the IXP.

The MAC address of a hardware interface is a unique number that follows the IEEE Standards Association standards, and it allows us to map the hardware to its vendor. Figure 2 depicts the standard MAC address structure. The first three octets represent the unique identifier of the vendor/manufacturer (e.g. Cisco or Huawei); the last three octets identify the network interface controller (NIC).

Figure 2: Structure of a 48-bit MAC address

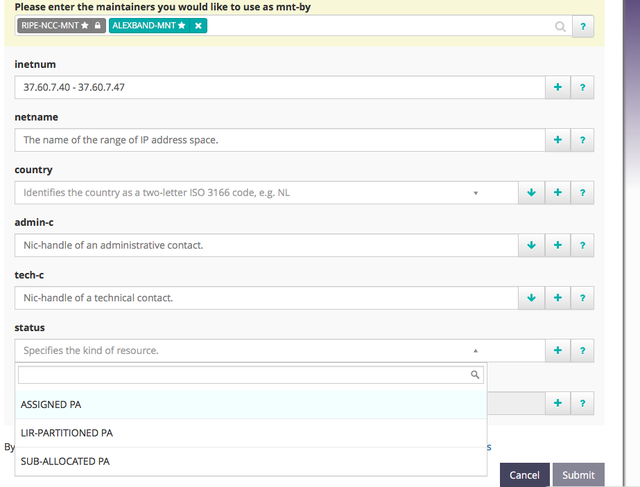

We can therefore use the first three octets of the MAC addresses to derive the vendor of the hardware. But how do we obtain that information from IXPs, given that one might expect it to be sensitive?

First, it turns out that a significant number of IXPs make that information publicly available on websites such as IXPDB and PeeringDB. On those websites, they provide MAC addresses, IP addresses and other information about their networks. Since IXPs are closed environments – the members are not reachable from the Internet – IP addresses and MAC addresses do not pose a security risk. We therefore leveraged these publicly available datasets in our study.

Second, with IXPs that do not make this information public, we contacted the IXP directly and asked for the data we wanted. Out of the fifteen IXPs we approached, ten shared the requested details with us and have granted us permission by e-mail to publish this information, so no privacy violation is involved.

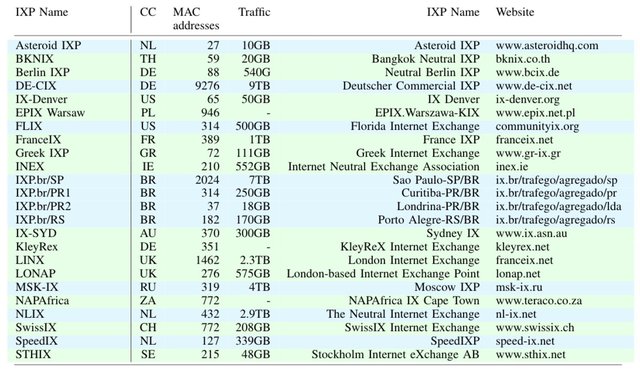

In total, we collected information from 24 IXPs globally, as shown in Table 1. These IXPs vary in numbers of members and interfaces connected to them (shown as MAC addresses in Table 1), ranging from 27 to 9276 interfaces.

Table 1: IXPs’ characteristics (updated October 2020). Data publicity available (green) and data provided by IXP (blue).

Which Vendors are Most Popular?

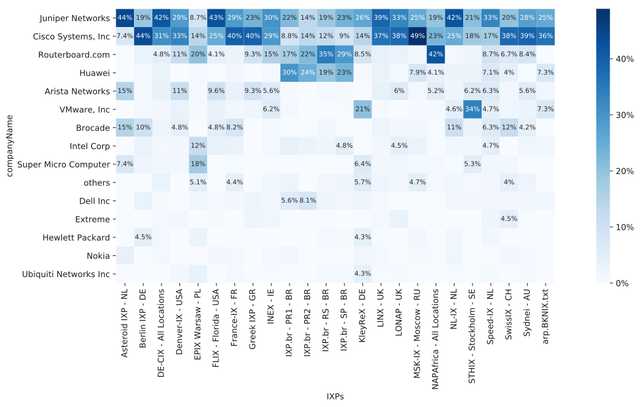

Figure 3 shows the distribution of hardware vendors among IXP members per IXP that we mapped. Let’s take Asteroid-IXP as an example. There, more than 40% of IXP members are using hardware from the vendor Juniper Networks and 7% are using Cisco hardware.

Figure 3: hardware vendor distribution over IXPs (click for details)

Overall, we observe that the most popular hardware vendors are Juniper and Cisco (first two lines). Together, they represent more than 50% of the hardware used by members in the majority of IXPs. RouterBOARD – the manufacturer of MikroTik devices – is the third most popular vendor, followed by Huawei. MikroTik devices are usually adopted by ISPs with lower budgets.

The fifth most popular vendor is Arista Networks. These devices support programmable networking architectures, such as SDN (software-defined networking). The use of programmable networks has been increasing in recent years, so mapping their adoption in IXPs gives us a glimpse of the popularity of such devices. In four IXPs, Arista is used roughly by 10% of their members (IXPs located in US, NL and GR).

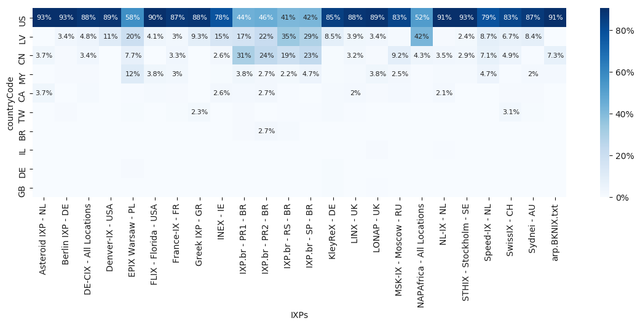

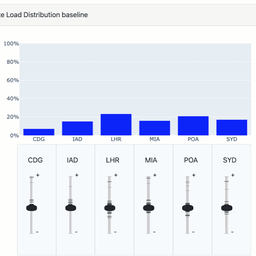

Another way to visualise our dataset is to group vendors by their country code, which represents where the company is based. Again using a heatmap plot (Figure 4), we have depicted the vendors' countries and respective concentrations among IXP members.

Figure 4: Percentage of hardware vendor by country code and IXP (click for details)

Overall, vendors from the US (Juniper, Cisco, Brocade, Arista, etc) are more popular in our dataset: over 80% of IXP members in the EU and the US use hardware from vendors based in the US.

Latvia (RouterBOARD), China (Huawei) and Malaysia (Intel) complete the list of the top four vendor country codes. Interestingly, IXPs located in Poland, Brazil and South Africa have a broader distribution. In those countries, around 50% of IXP members rely on vendors located in the US, and the remaining ones are distributed over Latvia, China and Malaysia. Further studies are required to understand the reason for this distribution.

Discussion

By analysing data from 24 IXPs and almost two thousand MAC addresses, we see that most IXP members connect to their IXPs using just two brands: Cisco and Juniper. The exceptions are members in Poland, Brazil and South Africa, where there is more diversity in the vendors used.

While we cannot say precisely why the members of these IXPs prefer those vendors (e.g. a lack of diversity in the market itself), we believe it does constitute a significant level of concentration. Interestingly, we recently measured a similar concentration towards a few US-based companies in the DNS, as our colleagues recently reported.

To conclude, this article measures the distribution of the vendors chosen by IXP members to connect to IXPs. Our results indicate that US-based vendors dominate the market, but that the vendor distribution is more diverse in some IXPs. It will be interesting to observe how this market develops, for instance in response to the EU’s push for more digital sovereignty.

Source code and datasets

We've made the source code and the anonymised dataset available at Github.

______________________________________

Adapted from an article originally published on SIDN Labs.

Comments 1

The comments section is closed for articles published more than a year ago. If you'd like to inform us of any issues, please contact us.

Hunter Newby •

Great insights, thanks