A record number of IPv4 addresses were transferred between LIRs in the RIPE NCC service region in 2017. However, 16 of the largest transfers, amounting to 78% of the total transferred address space, were really about the administrative management of resources between related business units. In terms of buyers and sellers, this part of the IPv4 transfer market decreased in size last year.

Since September 2012, when the RIPE NCC’s pool of available IPv4 addresses dropped to the level of one /8 (16,777,216 addresses), we have published statistics on the addresses transferred between Local Internet Registries (LIRs). A new allocation policy, which came into effect when we reached this last /8, entitles every LIR to one final /22 allocation from the RIPE NCC (1,024 addresses). LIRs that need more IPv4 addresses have to look to the transfer market, where previously allocated but no longer used address space can be purchased.

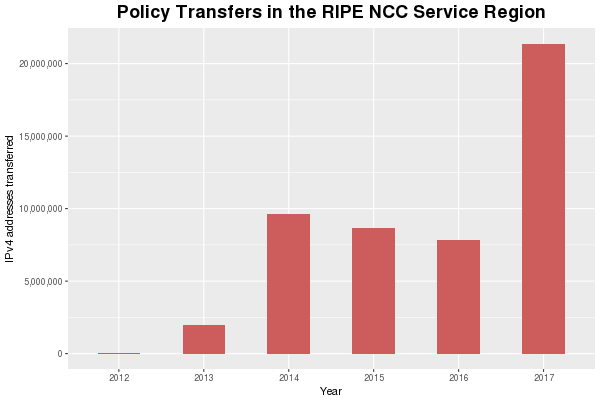

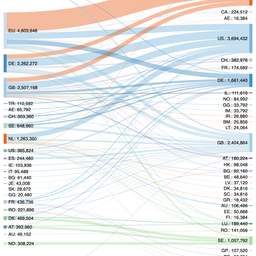

In an earlier report, we showed that in an emerging market, substantial amounts of IP addresses had moved between countries. After a very active 2014, the years 2015 and 2016 saw a slight decrease in the total number of addresses transferred via policy within our service region. For 2017, the statistics suggest at first glance that there was a sharp rebound in this part of the market. As illustrated in Figure 1 below, a record 21 million addresses moved from one LIR to another, more than double the amount of addresses transferred in 2014. However, when we look at the organisations that are the originators and recipients of these transfers, we find that a total of 12 million addresses moved between LIRs effectively held by Société Francaise du Radiotelephone S.A. Another 3.2 million were transferred within the Vodafone Group in the UK.

These administrative transfers, which are not sales and purchases on a market, have also happened in previous years. We mentioned this when we listed the organisations that transferred the most IPv4 addresses between May 2015 and May 2016, for example. But unlike in 2017, market transactions accounted for most of the IPv4 space transferred between LIRs in those earlier years. We estimate that from 2014 – 2016, something on the order of 10-15% of transferred IP addresses changed LIR for reasons other than buyers and sellers reaching an agreement on the market.

Figure 1: Policy transfers in the RIPE NCC service region since 2012

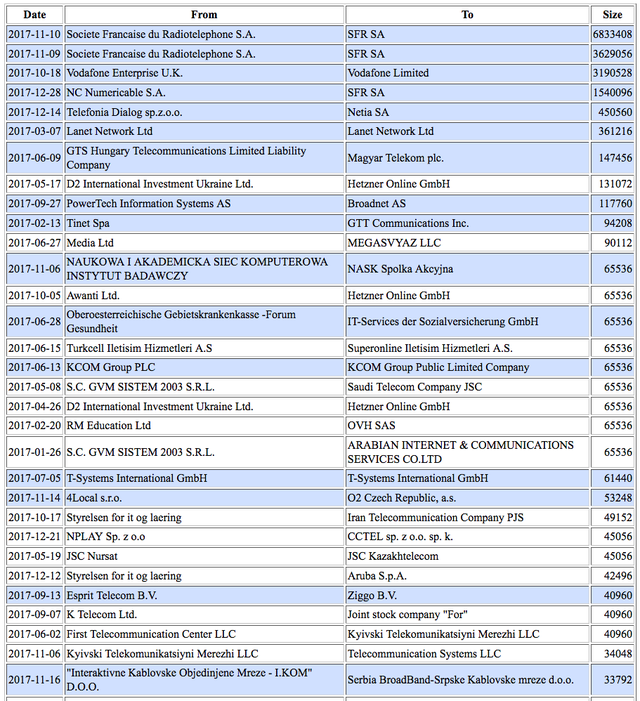

Examining the statistics further, Table 1 below lists the top transactions in 2017 where more than 32,768 addresses, the equivalent of a /17, were transferred from one LIR to another. Out of a total of 1,355, these 31 transactions account for 18 million addresses, or 83% of all addresses transferred that year. Looking at the names of the originating and receiving organisations, and performing a quick Google search when in doubt, we find that 16 of the transactions in the table were between related LIRs. These LIRs may be subsidiaries of the same group, may have ended up within the same legal entity as a result of acquisitions in the (distant) past, or might be the result of a business restructuring that resulted in a new entity which took part or all of the originating LIR's addresses with it. None of these cases are market transfers, but they account for 78% of the total IPv4 space transferred in 2017.

Table 1: Top transactions in 2017. Entries with a blue background are related LIRs. (click for larger view)

The remaining 1,324 transactions were not examined in detail, but still include some administrative transfers. For example, a quick scan showed twelve cases where the originating and receiving party were identically named. However, as the size of these transactions is comparable to normal market transfers, they are not expected to have much impact on the overall statistics. We thus estimate that around 4.6 million IPv4 addresses have been transferred on the market in the RIPE NCC service region via the RIPE Transfer Policy in 2017, continuing the downward trend from previous years. More than likely, this is caused by decreasing supply rather than decreasing demand for IPv4 addresses. A theory which is supported by the RIPE NCC's Transfer Listing Service: on 15 January 2018, the total IPv4 address space requested was more than a hundred times higher than the IPv4 address space offered for transfer.

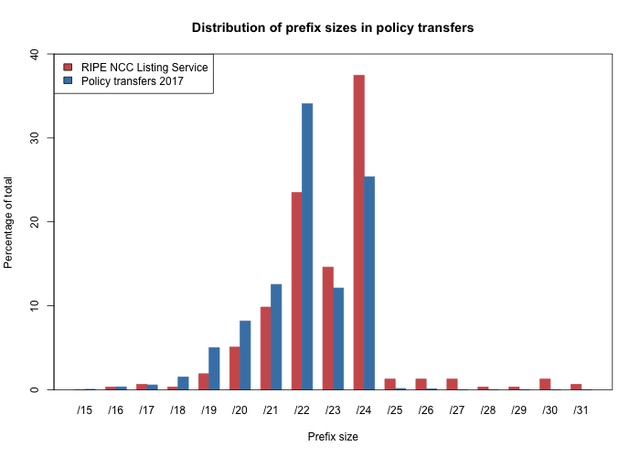

The transfer market for RIPE NCC-allocated IPv4 addresses continues to be dominated by modestly-sized blocks. Both the distribution of prefix sizes in the Transfer Listing Service and the distribution of prefix sizes transferred in 2017 show /24 to /21 blocks (256 to 2,048 addresses), to be the most common. Excluding administrative transfers, transferred blocks range from a /26 to a /15, while the listing service sees blocks from as small as a /31 up to a /16 offered. Figure 2 shows the full distributions.

Figure 2: Distribution of prefix sizes seen in the RIPE NCC Listing Service and the policy transfers of 2017

Conclusion

What conclusions can we draw here? In 2017 a relatively small number of transfers, which were administrative in nature, accounted for 78% of the addresses transferred in our service region via the RIPE Transfer Policy. While these transfers do reflect movements between LIRs (or LIR accounts), they shouldn’t be interpreted as sales and purchases on a market; they were not conducted to redistribute allocated-but-unused IPv4 addresses to other parties. This needs to be taken into account when analysing transfer statistics with the aim of identifying trends in the IPv4 market.

However, when talking about transfers of resources originally distributed by the RIPE NCC, the market is decreasing in terms of the total number of addresses transferred. At the same time, the number of transactions has grown slightly over the years, as the remaining pie is cut into ever-smaller slices. This indicates that organisations are still looking for additional IPv4 addresses, but supply cannot meet demand.

Finally, we want to stress that the trends observed here are not necessarily representative for the IPv4 transfer market as a whole. As the primary goal of the analysis was to highlight the dual nature of intra-RIR transfers in the RIPE NCC service region, we did not look at transfer statistics from APNIC or ARIN. In addition, legacy resources can be transferred without the involvement of an RIR. They are, by community policy, excluded from being listed in RIPE NCC's transfer statistics.

Comments 1

The comments section is closed for articles published more than a year ago. If you'd like to inform us of any issues, please contact us.

Elvis Daniel Velea •

very insightful numbers, Rene. Legacy blocks should be included, too bad the commmunity does not see the added advantage of observing a market in its entirety. Thank you, Elvis