Second in a series of articles about the structure of the ISP industry within the RIPE NCC service region. This time we try to identify criteria that make other economic sectors comparable to our own industry. We then test our assumptions by exploring a very simple comparison to the global automotive manufacturing sector.

Introduction

In our last RIPE Labs article on this subject IPv4 Concentration|Diffusion 2.0.1 , we examined the evolving cumulative distribution of IPv4 addresses distributed by the RIPE NCC to members between the mid-1990s to the end of June 2010. We concluded that our industry is amazingly open and varied. While there are a number of large organisations that received big chunks of IPv4 address space in the 1990s, there are also many new industry entrants that started later and made their way toward the top.

While the number of new member organisations has grown exponentially over the years, and many organisations have moved "up" and "down" in the system, the overall ratios of organisations populating each of 20% segments has remained fairly stable.

But is this a specific pattern seen in the ISP industry? Or is this also the case in other industries? We looked at other types of industries and in this article we compare the ISP industry with the global auto manufacturing industry.

Criteria for Industry Comparison

We were looking at concentration patterns in industries that share key features in common with the Internet sector. What elements are necessary to make another industry relevant and (at least potentially) interesting as a benchmark for assessing IPv4 distribution patterns in the Internet industry?

Transparent Data

For an industry to be considered as a potential comparative benchmark for IPv4 address distribution patterns, it must publish detailed and comprehensive data on key assets or market shares of individual industry members. This is necessary to permit comparisons to the kind of cumulative-IPv4-per-registrant time series data that is the basis of these articles.

The Regional Internet Registries keep detailed records of all resources handed out to members and other organisations in their respective service regions. This ensures uniqueness of resources, but in addition to that, it provides a public registry that shows which resources are used and maintained by whom.

It is difficult to find other industries that publish data with a similar level of detail, openness, and transparency to the public. As a result, many potentially interesting industries do not meet even the most basic mechanical requirements for comparability with the ISP industry.

Broad Participation in Global Markets

The industry must possess the possibility for organisations to grow in size and accumulate resources over time. It must also be possible for individual industry members to directly participate in a global market.

These requirements rule out many potentially interesting comparisons - but perhaps not all of them.

Comparison with Automotive Manufacturing Industry

Our first candidate for comparison is the global automotive manufacturing industry, as reflected in annual auto production statistics published by the International Organization of Motor Vehicle Manufacturers . Our research suggests that while there are clearly some differences between the two industries (some of which are detailed below), the automotive manufacturing industry posses all necessary features to make comparisons with the Internet industry possible and meaningful.

Similarities:

- Both, the ISP and the automotive industry, are characterised by large economies of scale, which enable individual producers to effectively serve the global marketplace.

- As a consequence, large producers in both sectors are typically engaged in cross-border customer-provider relationships in multiple regional and national economies.

Dissimilarities:

- Regional vs. global scope of industry metrics (For the Internet industry we were looking only at those organisations that have IPv4 address registered in the RIPE NCC service region. For the automotive manufacturing industry we are looking at companies worldwide).

- IPv4 addresses are production inputs; cars are final goods.

- Automotive production is not subject to any unique, industry-specific exogenous resource supply constraints.

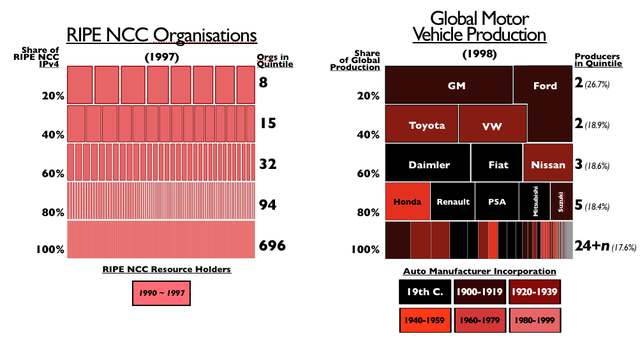

In Figure 1 below you can see the status of the ISP industry in the RIPE NCC service region in 1997 (on the left side) compared with the automotive industry in 1998 (on the right side).

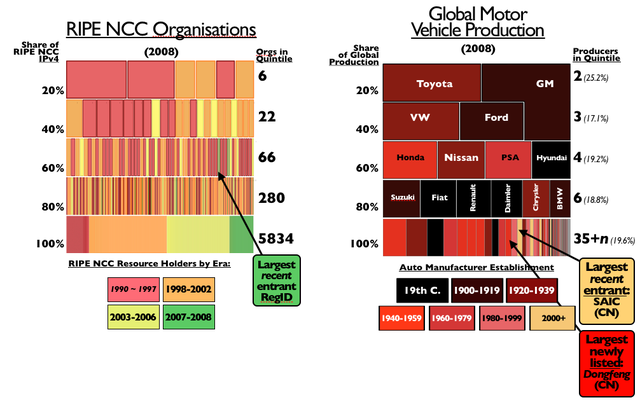

In Figure 2 you can see the status of the ISP industry in the RIPE NCC service region in 2008 (on the left side) compared with the automotive industry in 2008 (on the right side).

At the end of 2008, 100% of the IPv4 address space allocated or assigned by the RIPE NCC before that time was divided between 6,208 separate institutions, including 5,698 that were established after 31 December 1997.

In 2008, 98.6% of the global automotive production was divided between 49 separate manufacturers, including 18 that were not listed in 1998, and four that were established after 31 December 1997.

Whereas the ISP industry shows many new entrants and also a lot of "up" and "down" movement over the last ten years, there wasn't much change in the automotive industry.

Conclusion

Even though there are dissimilarities between the two industries that must be considered in any comparison (for more details, see limitations section below), we can see in the example of the automotive industry how a small number of organisations can dominate the entire global market place. The position a company has in the automotive industry hierarchy remains fairly stable over long periods - in some cases decades or even centuries. Finally, the sector appears to attract very few new entrants over time.

The concentration in the ISP industry has not changed significantly over time. Between 1990 and 2010 the number of organisations in the top quintile has not changed much. That means the ISP industry has not been increasingly concentrated in recent years. In fact the number of organisations in the top 4 quintiles has not changed that much. What is important though is that the number of organisations in the bottom quintile has increased significantly. That shows that the system is open for new entrants. And we can also see that organisations move up and down to different quintiles which shows that the system is flexible and allows organisations to grow and to accumulate more resources and increase their business.

It is not trivial to compare the ISP industry with other industries, because it is quite special in a number of ways. It is transparent, keeps detailed records and has been able to keep a remarkable level of industry self-regulation.

After we identified a number of comparable industries, we can conclude that it is quite normal for industries to show a certain level of concentration. And concentration (often illustrated as pyramid) as such is not bad. It only becomes problematic when there is no movement inside the pyramid and when organisations cannot move up or down based on how well or how badly they are doing. Another important aspect is transparency and peer pressure. If it is not clear anymore how decisions are made and based on which criteria organisations can move around in the system, it will become locked and eventually break down just like recently happened in the banking industry (more about that in the next part of this series).

Limitations

Three important caveats deserve mention here. First, the geographic mismatch between RIPE NCC IPv4 data and OICA's worldwide auto production metrics may distort the comparison in unknown ways. Second, OICA metrics only cover the auto industry's relatively homogenous and composite final goods -- i.e., number of complete automobiles produced -- whereas IPv4-based measurements capture a more diverse range of consumer-targeted products and services, as well as many "under the hood" components of Internet production. This means that the two data sources may exaggerate the gap between the industry populations (especially in the "smallest" industry quintile).

Finally, the fact that the automotive manufacturing is not subject to any unique, industry-specific resource constraints, or to anything like the "needs-based" allocation policies that emerged in response to IPv4 scarcity may raise serious questions about the legitimacy of all industry comparisons. In the next article in this series, we will put this question to the test by exploring a second industry comparison -- one that, we believe, more closely parallels the distinctive conditions that have shaped the IPv4 distribution patterns in all three of these problem areas.

Comments 0

The comments section is closed for articles published more than a year ago. If you'd like to inform us of any issues, please contact us.